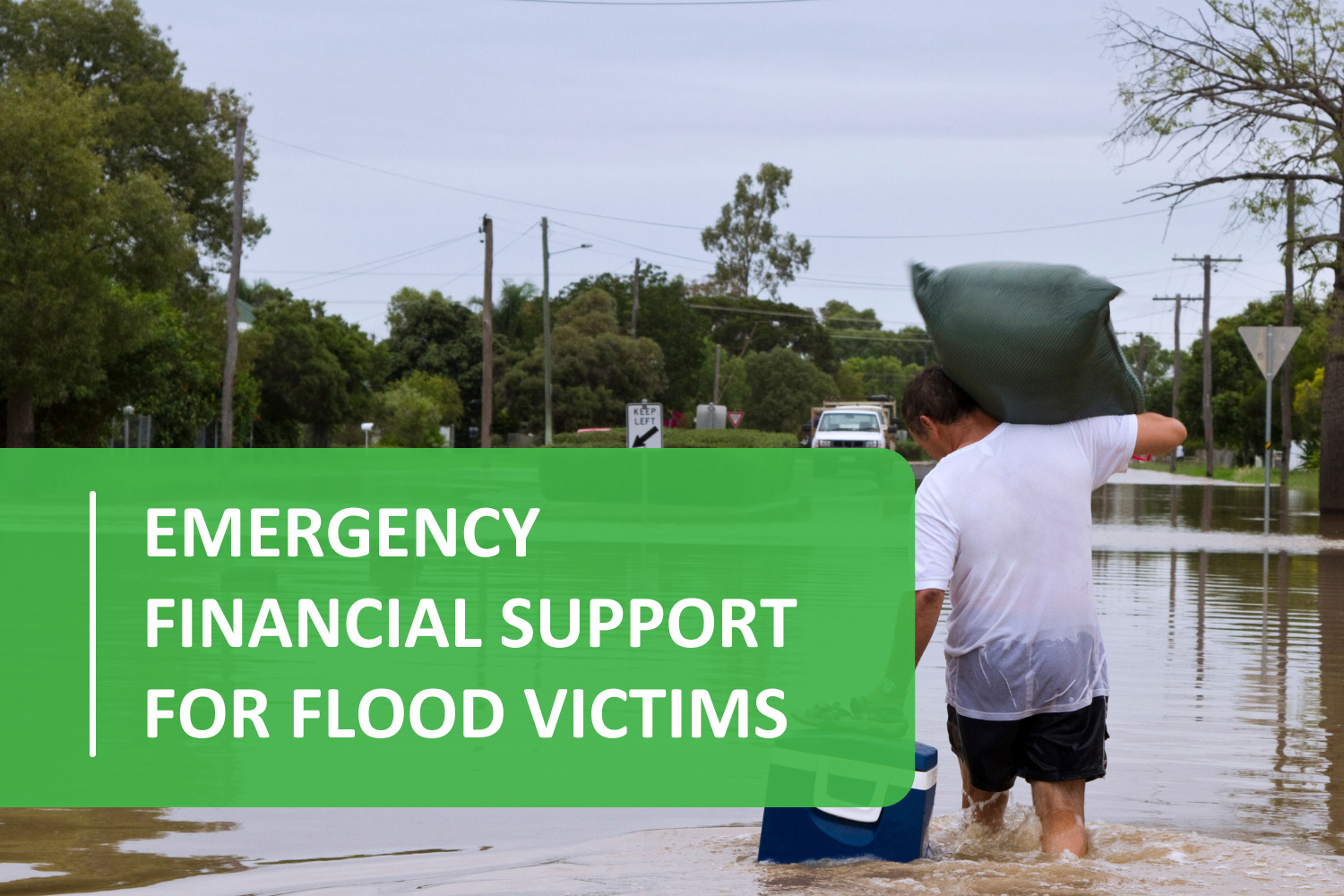

IS YOUR BUSINESS DISASTER PROOF?

A definite uptick in wild weather has not been just an inconvenience for people trying to get about their daily lives but at the other end of the spectrum, wild weather can have devastating impacts on small business if they are underprepared. Floods, cyclones and fires have the power to destroy communities and small businesses, … Continued