The Impact of Technology on Modern Accounting Practices

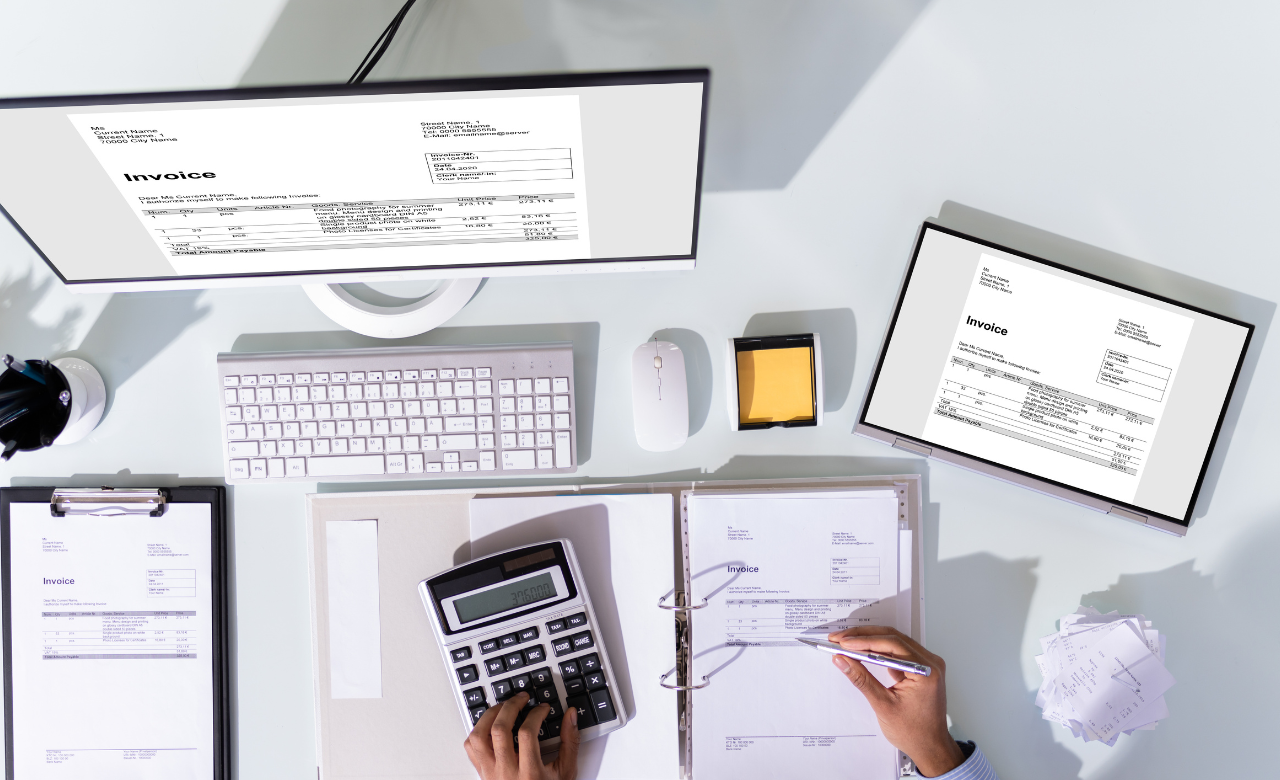

Is your accounting stuck in the past? Discover how tech-powered accountants can save you time and money and unlock hidden growth potential. Picture this: Your desk is buried under a mountain of receipts, invoices, and bank statements. You’re spending countless hours manually entering data, reconciling accounts and trying to make sense of it all.Meanwhile, your competitors … Continued