Making the most of your bonus!

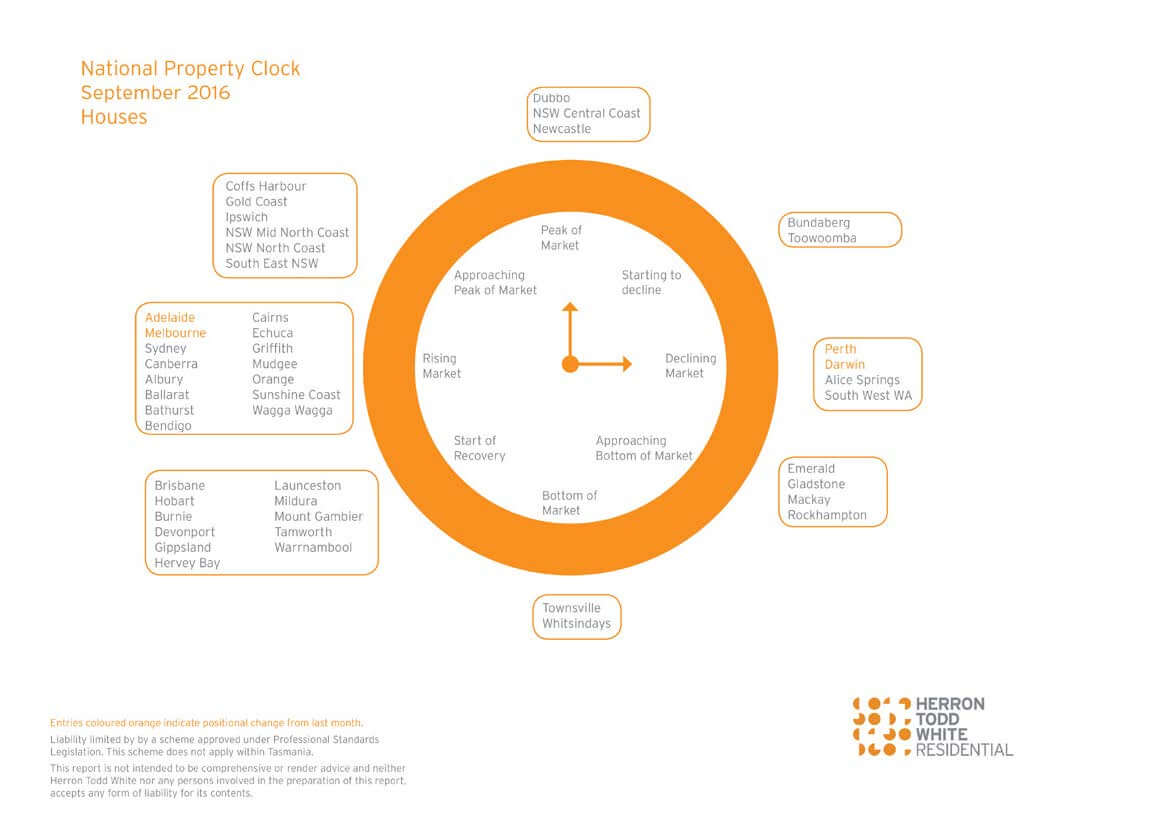

At this time of the year, some of us are fortunate enough to be in ‘bonus’ discussions with our employer. If you are gearing up to receive a bonus this year, there is certainly no shortage of possibilities of what to do with it. Save or splurge? Christmas is just around the corner as is … Continued